Banking and Finance Symposium Tackles AI, Regulatory Issues

Annual conference breaks attendance record, contributes to professional continuing education

OXFORD, Miss. – The University of Mississippi hosted an elite group of U.S. financial professionals Friday (Nov. 8) to discuss industry challenges and innovation at the 23rd annual Banking and Finance Symposium.

The symposium, hosted by the UM School of Business Administration, attracted more than 300 financial professionals – the event's largest crowd to date – to the Oxford Conference Center for group sessions ranging from cybersecurity and the dark web to growing banks in uncertain times.

"The goal at the very top level is education," said Ken Cyree, UM business school dean. "It's to educate these financial professionals about the current environment and trends to consider so that they can plan ahead strategically and potentially identify opportunities for the future."

Michelle "Miki" Bowman, a member of the Federal Reserve System's Board of Governors since 2018, was one of the keynote speakers. With experience in both state and community banking, she expressed a desire to see regulatory agencies explain the "why" behind their decision-making, creating a more supportive environment.

More than 300 financial industry professionals hear from experts in the industry at the 2024 Banking and Finance Symposium at the Oxford Conference Center. The crowd set a new attendance record. Photo by Hunt Mercier/Ole Miss Digital Imaging Services

"Regulated agencies have either become too aggressive or lazy in the way that we draft our regulations," Bowman said. "We don't provide enough context. We don't identify the problem we're solving.

The Fed is aware that several issues exist within the banking industry that could likely use a solution regulating agencies, Bowman said.

"There are opportunities; we've just not been addressing," she said.

"It's time for us to confront what those are and to actually do some work that would be beneficial to the industry and beneficial for your ability to innovate and move forward in an environment where customers are expecting a lot more from you."

John Augustine, chief investment officer at Huntington National Bank, shared an economic outlook and emphasized projections from the International Monetary Fund that show the U.S. is not headed into a recession over the next 6-12 months.

However, on the heels of this week's election, Augustine discussed President-elect Donald Trump's proposed policies that include replacing some taxes with increased tariffs.

"This is going to be a big debate going forward," Augustine said. "The perception right now, right or wrong, is that President-elect Trump's economic policies are going to be inflationary."

Discussions around innovation within the banking and finance industry took center stage throughout the symposium.

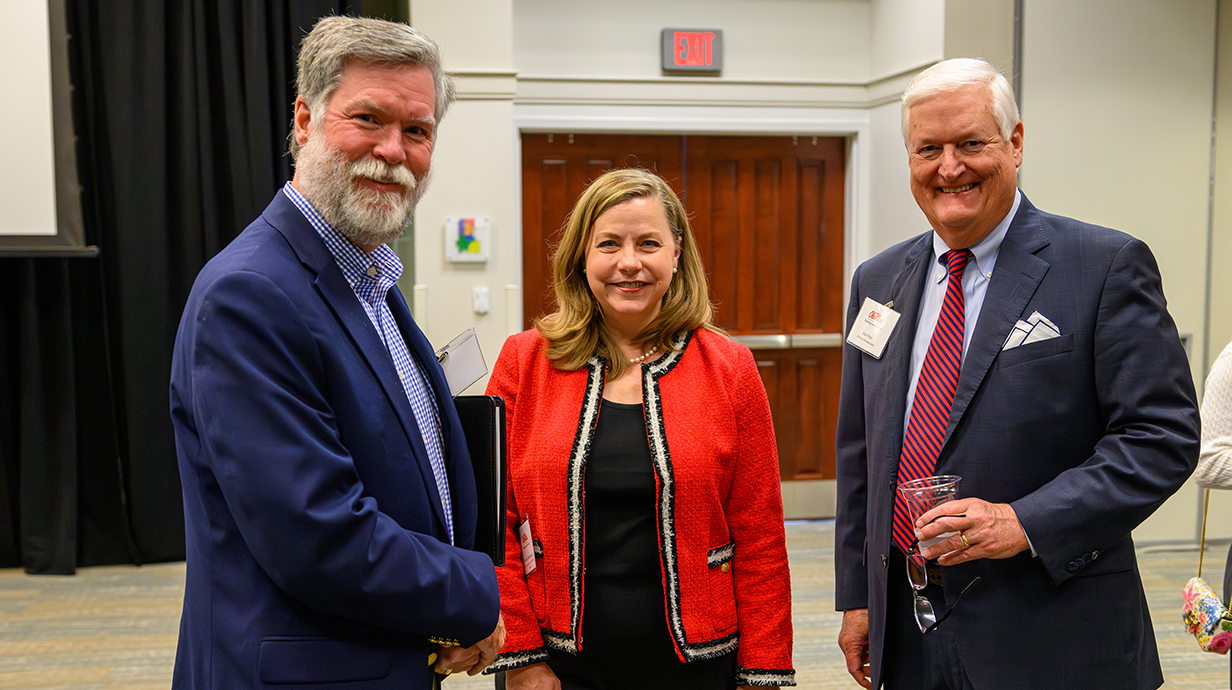

Ken Cyree (left), dean of the School of Business Administration, and Stan Viner (right), chair of the Ole Miss Banking and Finance Advisory Board, greet Michelle Bowman, a member of the Federal Reserve’s Board of Governors and a keynote speaker at the 2024 Banking and Finance Symposium. Photo by Hunt Mercier/Ole Miss Digital Imaging Services

Greg Adelson, president and CEO at Jack Henry & Associates, discussed how artificial intelligence has all but eliminated language barriers and streamlined processes for customer service teams.

"We're taking what we call a responsibly bold and balanced approach to AI," Adelson said.

"We found a ton of (AI) opportunity in our HR roles and in our contract process that we've been working through."

Jill Castilla, president and CEO of Roger, shared how she is finding success after launching the Roger banking app, which is tailored to the needs of military members and their families.

The myriad of topics underscores the continued evolution of the industry and importance of the annual event, said Stan Viner, chair of the Ole Miss banking and finance advisory board.

"We're seeing the convergence of technology and how these advances are empowering banks, regardless of their size or where they are located," Viner said

"You can't have a conversation about this without talking about AI and the fact that this industry will be changed and has already experienced changes from AI. Most of those changes will be for the better because of services that can be offered and the efficiencies that allow some of these banks – some of which are small, community banks – to compete with anyone in the country.

"It's a great equalizer, just like education."

Top: Michelle Bowman, a member of the Federal Reserve’s Board of Governors, discusses opportunities for improving the banking industry at the 2024 Banking and Finance Symposium, hosted by the School of Business Administration. Photo by Hunt Mercier/Ole Miss Digital Imaging Services

By

Marvis Herring

Campus

Office, Department or Center

Published

November 08, 2024