Pre-Tax Deduction Option

The pre-tax deduction option allows you to deduct parking fees before taxes are taken out, reducing your taxable income. You must be enrolled in payroll deduction to select the pre-tax deduction option.

Payroll deductions will follow the below schedule.

Payroll deductions will begin with the August 31st paycheck and be deducted in equal amounts each pay period for 9 months, for permits purchased between July 1 and August 19th.

Permits purchased after August 19th will be payroll deducted on a prorated basis.

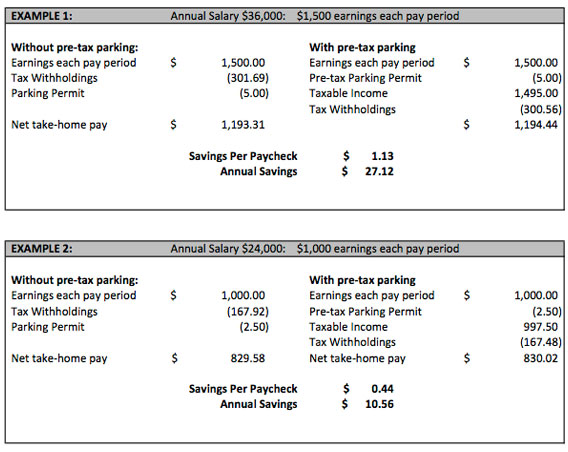

Sample calculation of pre-tax savings for permits purchased between July 1 and August 15:

*Taxable pay equals gross pay minus the cost of the parking permit in the sample calculation. The taxable pay reduction for tax purposes does NOT apply unless the benefit is chosen.

**Actual taxes will vary depending on each employee's withholding election.

***Tax savings are realized with the pre-tax parking benefit in this sample calculation.